The Russian Ruble - recovery or receding tide before tsunami

Join me on the roller coaster that has been the exchange rate of the Russian Ruble

In a break from this Substack’s usual fictional content in Bulgarian, this post will be in English covering an economic topic - particularly the Russian economy and the exchange rate of its currency, the Rouble, relative to other leading global currencies like the US dollar.

The road to 100

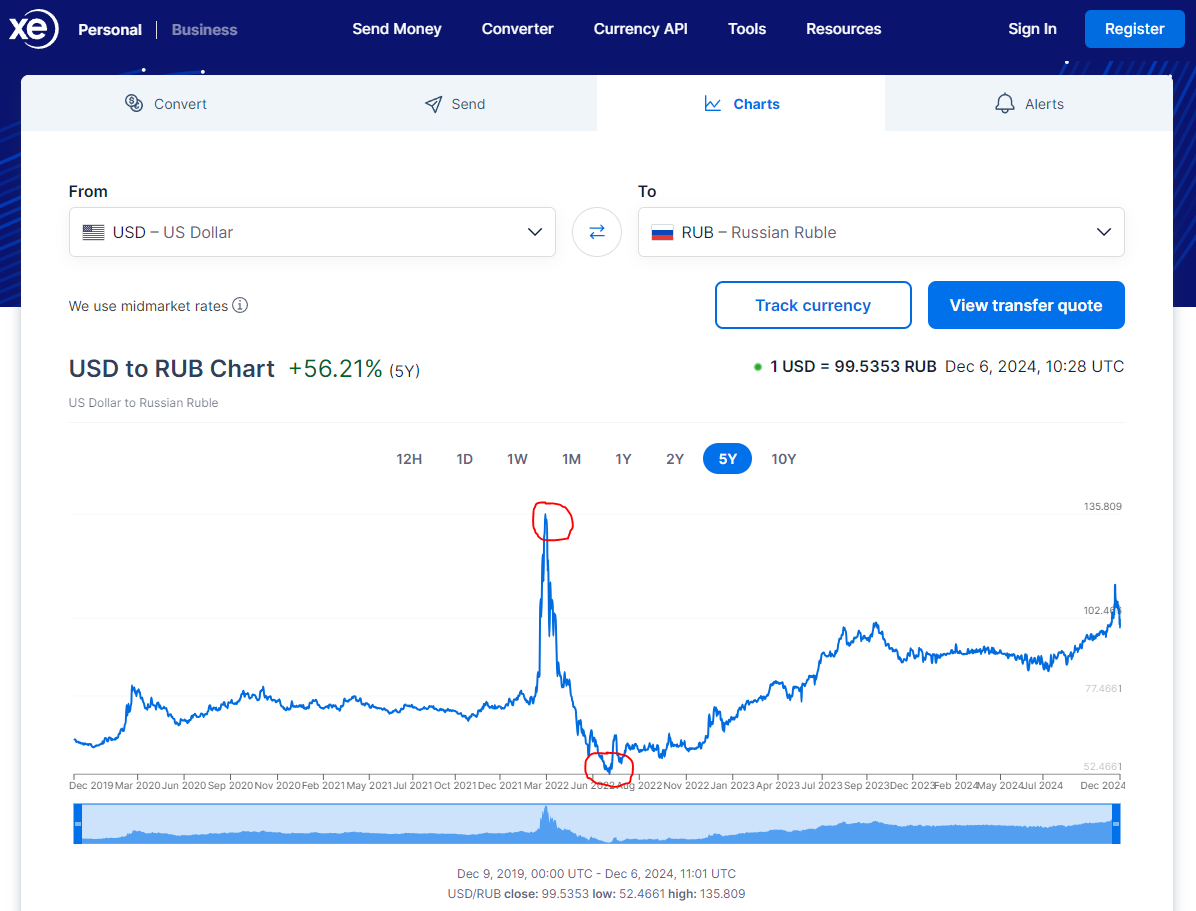

For months the Ruble has been trending downwards, losing value relative to the dollar and other currencies, moving it seemed to the low psychological barrier of 100 Rubles for one US dollar. In late November the Ruble crossed this border, and within a period of two weeks first stabilized around 103 for one dollar, then dropped to as low as 113 for one dollar, then stabilized at around 106 for a dollar, and then seemed to start moving towards recovery, even climbing back to less than 100 for one US dollar at the time of writing this.

I have written an article comparing the volatile behavior Russian Ruble to a crypto shitcoin. Linked here, but it’s in Bulgarian.

Despite what the rutrolls online might want you to believe, the Russian government and central bank are very much concerned with the exchange rate of the Ruble relative to the US dollar and other global, international, widely used and traded currencies, and they don’t like seeing the rate below 100 for one US dollar, considering how in years past, especially before the war, the Ruble was as strong as 50 for one US dollar.

Both having a strong and a weak currency has its strengths and weaknesses. If your country is a resource and raw materials export-based economy, it could be beneficial to have your currency weak relative to other currencies, as that makes your exports more attractive. Whereas if your country has a strong currency, it has more purchasing power to import goods from elsewhere in the world.

China is an example of a country that purposely deflates its currency and tries to keep its value low relative to the dollar in order to maintain its export goods price-competitive. But unlike China, which literally produces everything under the sun, Russia imports a lot of finished goods and products, while relying mainly on exporting resources and raw materials, which are goods with low added value. A weak Ruble would make Russia’s imports more costly, and Russia is far from being self-sufficient or autarkic.

Road to recovery or coming storm?

Of course now that the Ruble seems to be on the road to recovery, the rutrolls will be the first to celebrate it’s rise to trading for under 100 for one US dollar, even though they would be the ones telling you it doesn’t matter when it’s dropping to lower than 100 for one US dollar. Ruble stronk! Pay no mind to the woman behind the curtain!

The woman behind the curtain is Elvira Nabiullina. She is the governor of the Russian central bank, and I do not envy her position. She is tasked with trying to stabilize the Russian Ruble and keep it from collapsing.

Remember back shortly after the start of the war when the Ruble dropped to as much as 135 for one US dollar?

If it’s so good for an export economy, why didn’t they just let the exchange rate fall? Instead they scrambled to save the Ruble by any means necessary. They increased the key interest rate, and have kept increasing it since then, up to 21% in early December, and they may increase it again by the middle of the month. They instituted limits on how much foreign currencies businesses and private individuals can hold, requiring that 80% of your account is in Rubles. And most importantly, they have been selling their reserves of both foreign currencies that they still have available, that have not been frozen under western sanctions, selling their gold reserves, and also dipping into their sovereign fund.

And lo and behold, they seemed to have saved the Ruble by summer 2022. It strengthened up to as much as 52 for one US dollar. Take that, western sanctions! Russia stronk! Ruble stronk! Of course whenever peace is mentioned, besides getting to keep all the Ukrainian land they’ve taken, the other main demand Russia makes is lifting all sanctions before they even come to the negotiation table. But otherwise the sanctions have no effect on them, they are perfectly fine under the sanction regime.

However, since then the Ruble has kept weakening. The effect of the applied shock therapy seemed to be diminishing, and the Ruble again passed 100 for one US dollar in October 2023, before stabilizing around 90 for a while, and then again starting to drop.

It’s not so much that the US dollar has exploded in value as much, even after the US election, compared to every other currency, commodity, Bitcoin, or any other metric you want to use, it is the Ruble that is devaluing, it is worth less globally, and it is buying less domestically. But that’s not something that the rutrolls want you to think about. They would say “but what about the Japanese Yen, or the South Korean Won?“ Yes, what about them? They have not lost as much value relative to the dollar over the same periods. But the Ruble has also lost value relative to them.

The tsunami can not be stopped

The movement of the Russian Ruble is not market driven. There is no global market for the Ruble. Even Russia’s last remaining major trade partners, China and India, prefer to trade with Russia in their own currencies, and Russia ends up with a lot of Chinese Yuan and Indian Rupees in exchange for the fossil fuels it sells to those countries at a discount relative to global market prices. Not only that, but these Yuans and Rupees end up sitting in Russian accounts in Chinese or Indian banks, and they are having difficulties getting their money out of there, as specifically Chinese banks are worried about being targeted by western secondary sanctions.

Inside Russia no one is really buying a lot of Rubles either, so there really isn’t a domestic market for the Ruble. The only entities buying up the Ruble to keep its price up are the Russian government and central bank. And they are buying it at the expense of gold reserves and other foreign currency reserves they may still have available. Every magic trick they can pull, every bit of abracadabra is going into them trying to keep the Ruble stronger than 100 for one US dollar to save face. They are trying to keep up the facade, the Potemkin village that is the international exchange rate of the Ruble, which is the last publicly available indicator of the state of the Russian economy that they haven’t censored to the outside world.

I don’t know what they’re selling, and what long-term sacrifices they are making to get the recovery effect of the Ruble, but I think the effect will be short-term, and not only will the effect expire, and the Ruble will continue to drop in the future, but also the effects of all the stabilization measures that they have implemented will come to bite them on the ass.

The tsunami is coming. Brace yourselves.